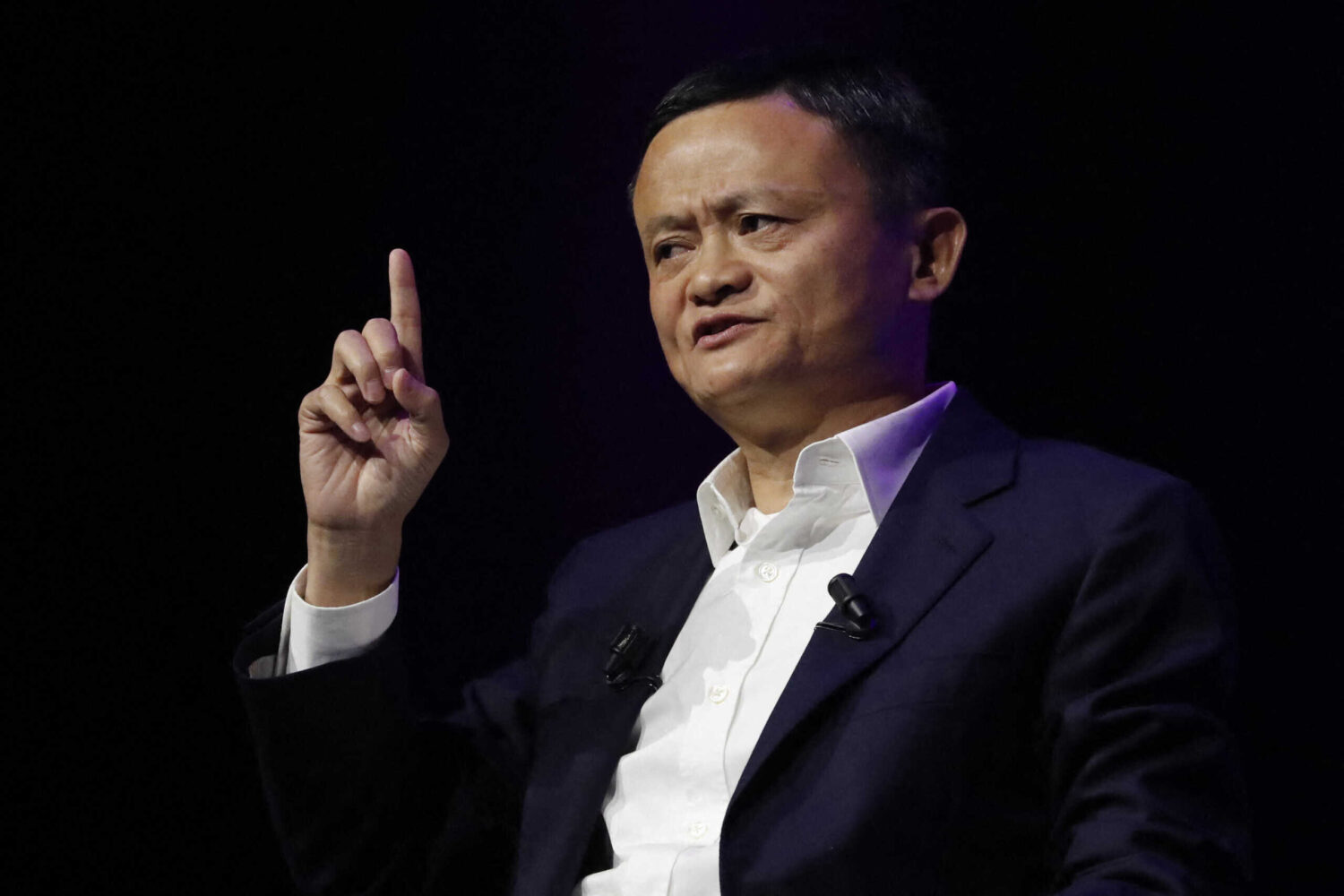

HONG KONG – In what could mark a turning point for China’s economic policies, President Xi Jinping convened a high-profile meeting with some of the country’s most influential technology executives in Beijing on Monday. Among the notable attendees was Jack Ma, the co-founder of Alibaba, who had largely retreated from the public eye following a regulatory crackdown that reshaped the nation’s business landscape. His presence at the meeting suggests a shift in the government’s stance toward private enterprise, signaling a possible recalibration after years of stringent regulatory measures.

Joining Ma at the gathering were several other business heavyweights, including Ren Zhengfei, the founder of telecommunications giant Huawei; Wang Chuanfu, the CEO of electric vehicle leader BYD; Zeng Yuqun, the CEO of battery manufacturer CATL; and Lei Jun, the CEO of smartphone maker Xiaomi. The attendance of these industry titans highlights the significance of the discussions, which come at a time when China’s economy faces mounting challenges and an increasingly competitive global landscape.

The meeting was held just weeks after a major breakthrough by Chinese artificial intelligence startup DeepSeek, whose latest AI model delivered performance comparable to that of top American competitors while operating at a fraction of the cost. This development has reignited optimism in China’s tech sector, which had suffered a prolonged period of uncertainty following years of aggressive regulatory intervention. The government’s scrutiny of private enterprises, particularly in the technology and fintech sectors, led to a dramatic loss of market value for major corporations, raising concerns about China’s long-term innovation prospects.

Jack Ma’s participation is particularly noteworthy, given his complex relationship with the Chinese government. Once celebrated as a symbol of China’s entrepreneurial success, Ma became an emblem of Beijing’s regulatory crackdown after he criticized financial regulators and state-owned banks in a 2020 speech. His remarks triggered an unprecedented intervention that resulted in the abrupt suspension of Ant Group’s record-breaking IPO and a broader campaign to rein in the influence of China’s most powerful tech companies. In the aftermath, Ma largely disappeared from public engagements, making his presence at the meeting with Xi Jinping a significant development.

The inclusion of these top executives suggests that Beijing is reassessing its relationship with private businesses at a time when economic headwinds are growing stronger. China’s post-pandemic recovery has been weaker than expected, with its property sector in crisis, consumer spending sluggish, and external pressures from U.S.-China trade tensions escalating. The private sector, which contributes more than 60% of the country’s GDP and provides over 80% of jobs, has been increasingly wary of Beijing’s statist approach, leading to a decline in investment and expansion efforts.

Financial markets reacted swiftly to the news of the symposium, with the Hang Seng China Enterprises Index climbing to its highest level since early 2022 before easing slightly on Monday. Investors and analysts view the meeting as an indication that Beijing may be pivoting toward a more business-friendly approach, recognizing the crucial role of private enterprise in stabilizing the economy.

Angela Huyue Zhang, a law professor at the University of Southern California specializing in China’s regulatory landscape, emphasized the broader implications of this meeting. “With the domestic economy slowing and geopolitical pressures escalating, the government is making it clear that it values and relies on the private sector to drive innovation and stimulate growth,” Zhang told CNN. Her analysis suggests that while past regulatory measures sought to establish tighter control over major corporations, the current shift may reflect a realization that overly restrictive policies have hindered China’s economic dynamism.

For years, Beijing’s regulatory actions wiped out over $1 trillion in market capitalization from major Chinese companies, sending shockwaves through global markets. The crackdown targeted a wide range of industries, including online education, e-commerce, fintech, and food delivery, prompting many business leaders to adopt a more cautious approach in expanding their operations. While regulatory tightening appeared to have eased in the past year, uncertainty remained, leaving investors and entrepreneurs wary of Beijing’s long-term intentions.

Xi Jinping’s decision to bring together these leading entrepreneurs suggests that China’s leadership is attempting to restore confidence within the business community. Whether this marks the beginning of a lasting policy shift or a temporary strategic adjustment remains uncertain, but the very presence of Jack Ma—who once embodied both the rise and the regulatory downfall of China’s private sector—underscores the gravity of the moment.